1031 Exchange Florida

Reinvest Capital Gains Tax into Florida Property

What is a 1031 Exchange?

1031 Exchange refers to the section of the Internal Revenue Code Section that provides for the tax deferred exchange of real and personal property.

Why do a 1031 Exchange?

With a 1031 Exchange investors can trade up, consolidate, diversify, leverage or relocate their investments and not be penalized by having to pay either capital gains or recapture (the amount deducted while owning the property is taxable if the property is sold). The taxes are deferred until the investor does a non 1031 Exchange sale or the property goes to the investors estate.

Many investors find themselves requiring a 1031 like kind exchange replacement property and that’s why Orlando is one of the most popular options.

1031 Time Frame Rules

There are two key timing rules you must observe in a delayed exchange.

- The first relates to the designation of a replacement property. Once the sale of your property occurs, the intermediary will receive the cash. You can’t receive the cash, or it will spoil the 1031 treatment. Also, within 45 days of the sale of your property, you must designate replacement property in writing to the intermediary, specifying the property you want to acquire.

The IRS says you can designate three properties so long as you eventually close on one of them. You can even designate more than three if they fall within certain valuation tests. - The second timing rule in a delayed exchange relates to closing. You must close on the new property within 180 days of the sale of the old.

Note that the two time periods run concurrently. That means you start counting when the sale of your property closes.

If you designate replacement property exactly 45 days later, you’ll have just 135 days left to close on the replacement property.

“Like-Kind” is Broad-Based

Most exchanges must merely be of “like-kind”—an enigmatic phrase that doesn’t mean what you think it means. You can exchange an apartment building for raw land, or a ranch for a strip mall. The rules are surprisingly liberal. You can even exchange one business for another.he net sale price of property you are selling.

The 95% Rule

Allows you to identify unlimited property options as long as you purchase 95% of the properties identified.

These options can be complicated, we strongly encourage you to discuss in detail with a Qualified intermediary (QI) to ensure the latest and most accurate information.

Replacement Property Identification / Designation

The Three Property Rule

is the most common, allowing you to identify up to but no more than 3 options of any market value. You can purchase one,two or all three of these options. You can change your mind as many times as you like on these designated options as long as you are withing the 45 day period.

200% Rule

You can designate any amount of properties as long as total market vale of these properties does not exceed 200% of the net sale price of property you are selling.

The 95% Rule

Allows you to identify unlimited property options as long as you purchase 95% of the properties identified.

These options can be complicated, we strongly encourage you to discuss in detail with a Qualified intermediary (QI) to ensure the latest and most accurate information.

Selling 1031 exchange property as nonresident

It’s a good question we get commonly asked. It depends on the circumstances.

Please let us know if we can help you ascertain that knowledge, we’d be happy to help.

Why a 1031 Exchange Florida?

Florida offers many great investment opportunities for tax deferral, central and the Orlando, Kissimmee and Davenport area in particular offers a diverse selection of popular income short term rental vacation homes. As the family vacation capital destination of the world, Orlando offer a time proven stream of rental revenue along with a historically solid appreciation. Short term has the added bonus of personal use and lifestyle investment – so three great ways to invest in one product.

A Florida 1031 Property Specialist is Available to Help

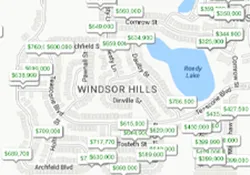

SEARCH VIA MAP

Vacation Home Property Map

RESEARCH DIRECTORY

Buying, Managing & ROI Explained

READ BUYER REVIEWS

Hear From Experienced Buyers

READ BUYER REVIEWS

Hear From Experienced Buyers